Day in a crypt: Risky regulatory manipulations, Bitcoin sends regards to deceived J.P. Morgan

Hello!

Today is March 21, 2023, and it is the 3662nd day that Bitcoin (BTC) has been running smoothly 24/7.

News in brief

- The reports from colleagues still indicate that finding new banking partners for BTC and the crypto industry in the US is currently more difficult than desired, but more innovative solutions are being sought as alternatives to traditional banks.

- The European Parliament is expected to return to the MiCA crypto regulation for the EU on April 18th, and shortly thereafter a final vote should be held, which has already been postponed several times.

- Florida Governor Ron DeSantis has proposed banning the use of CBDCs (central bank digital currencies) in his state and other countries, as according to him, CBDCs are detrimental to innovation and only serve to strengthen surveillance of citizens. Meanwhile, the International Monetary Fund writes in a new report that CBDC creators will need to consider the characteristics of Islamic banking if such tokens are to be used in these markets.

- BTC payment improvements: "Swiss Bitcoin Pay" has introduced a BTC "Lightning Network" payment card that helps to confirm larger payments additionally.

⚡WORLD FIRST⚡

— 🇨🇭 Swiss Bitcoin Pay (@SwissBitcoinPay) March 20, 2023

🔒 The Swiss Bitcoin Pay Card becomes the first Bitcoin Lightning NFC card to support 2FA authentication to approve a payment.

📱 You can configure in your dashboard a threshold amount from which all payments above will require a second validation on your phone: pic.twitter.com/BhuNoefKeq

- One of the major crypto exchanges, OKX, announced that it will withdraw from Canada this June due to new regulations.

- NFT wash trading grew for the fourth consecutive month and spiked by 126% in February to USD 0.58 billion, according to CoinGecko data. However, it was still significantly lower than the previous record of USD 11.56bn. Wash trading occurs when NFT traders move assets between their own wallets, artificially inflating trading volumes, and such behavior is encouraged by NFT platforms themselves, rewarding traders for achieving certain trading volumes.

Also read about dishonest regulators, market review, new banking models, and another reminder of the shortcomings of trust-based systems.

Topic of the day

The latest requirements from Belgium's regulatory agency regarding crypto advertising remind us of the regulators' double standards and the importance of words

The Belgian financial regulator FSMA states that as of May 17th, BTC and crypto industry ads must include the following statement: "Virtual currencies, real risks. The risk is the only crypto guarantee." Companies must also inform the FSMA in advance of any planned mass advertising campaigns. At the same time, the FSMA is launching an educational program on "virtual currencies," which are "uncovered" by the "real" world's assets and have risks associated with fraud and IT (in other words, like euros).

The announcement may not seem particularly unique, but it is interesting/important for another aspect - how regulators communicate unfairly about the BTC and crypto market. This can be done out of ignorance or simply due to opaque intentions.

However, it is necessary to emphasize that risks should be communicated. But now the FSMA is simply repeating other regulators' unfair practices and applying discriminatory policies. For example, does the FSMA require that the only guarantee here is risk to be mentioned for all other investment proposals? When discussing euros held in bank accounts, other investment products, and derivative instruments, does the regulator also use the word "virtual," as if emphasizing their uncertainty?

Here, the FSMA reminds me of a life insurance salesman who tried to convince me that their investment product had no risks. And now we can only imagine how many people have been harmed by such essentially legitimized lies.

If regulators/governments had actually done their job in the field of financial literacy, they would now need to pay additional attention only to their own education about technologies and then share this knowledge with market participants, as the basic investment principles probably work everywhere and the risks are everywhere.

There are many examples of such dishonest communication when talking about BTC's benefits, "mining," etc. (Another opportunity to remind how the European Central Bank manipulates.)

The next question is what would be more useful for investors - such warnings and "education" or truly honest discussions about new technologies and related risks? Perhaps, one can also recall warnings in alcohol advertisements or the scary pictures on cigarette packs - it is unlikely that they really work.

FSMA's survey also indicates that regulators are not doing what they should. Last November, marked by the billion-dollar collapse of the FTX exchange, FSMA surveyed 1,000 investors, and only 7% said they would no longer trade "virtual currencies" due to such a "crypto winter."

In other words, fair exploration of innovation and open discussions about it seem to be the best approach.

Day in the market

As we await the decision on interest rates from the Fed tomorrow, the BTC rally has slowed down and trading volume has decreased, with the price hovering around USD 28,000. Meanwhile, the current dynamic market also reflects the sector of derivative financial instruments. Despite BTC's price slightly increased in recent days, stronger price fluctuations along the way have led to more liquidation of trading positions that were betting on BTC's appreciation.

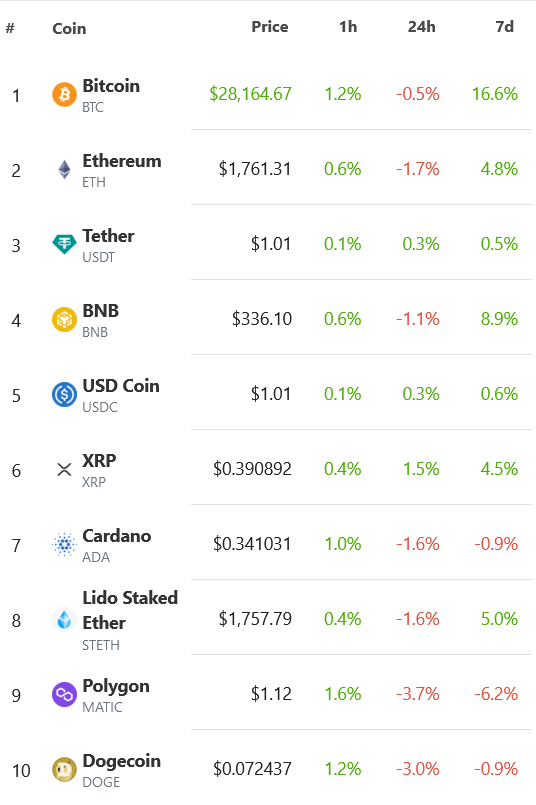

BTC and crypto market today

- According to CoinShares data, despite the BTC surge seen last week, investment crypto products emptied for the sixth week in a row - USD 95 million was withdrawn (USD 255 million was withdrawn the week before). It is commented that this was partly due not to negative sentiment, but to investors needing to ensure liquidity during the "bank crisis" as was the case during the COVID panic in March 2020.

- Bernstein analysts say that traditional institutional investors have not yet actively participated in the BTC rally, but they may finally be forced to do so, which could lead to even bigger price surges (if, of course, those investors are truly "forced" to participate).

- Matt Malley, Chief Market Strategist at Miller Tabak + Co., speculates that the recent BTC surge was primarily due to increased liquidity in the market, rather than investors' belief that BTC is a safe haven. According to him, after the crisis subsides, it will be difficult for BTC to rise above USD 30,000.

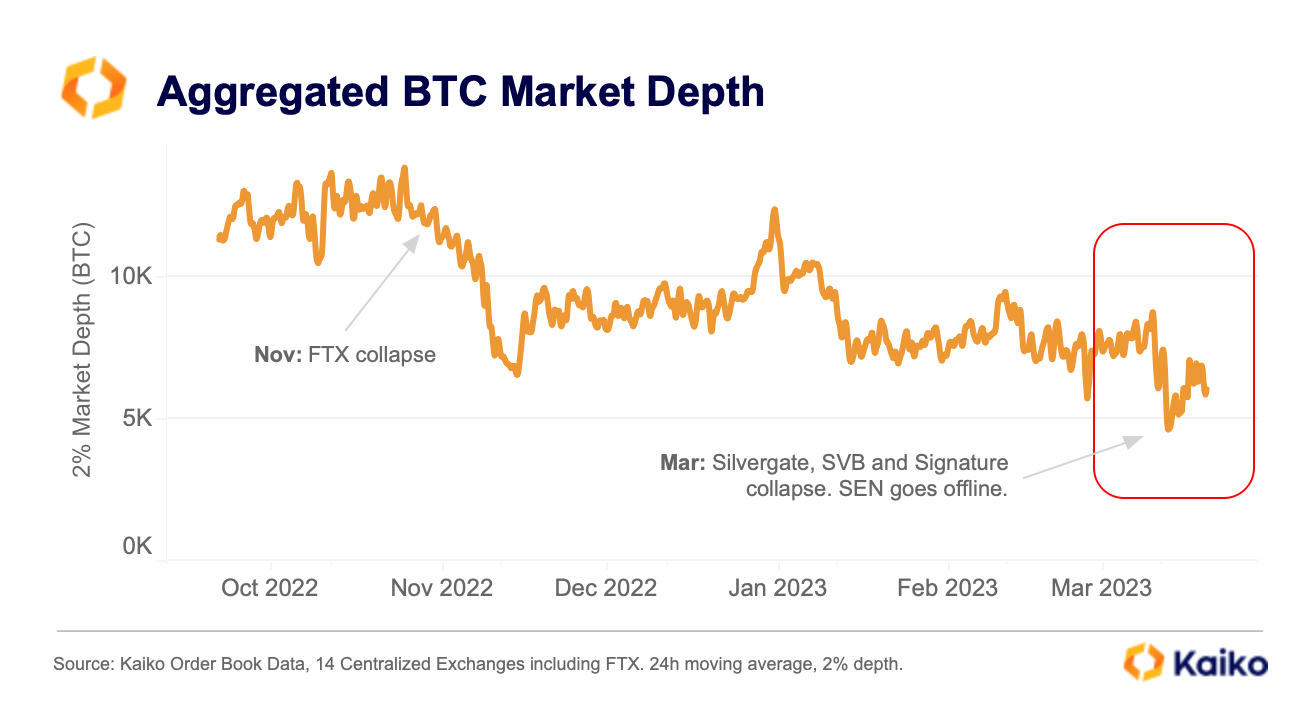

- Kaiko analysts point out that although liquidity in the BTC market has increased slightly, it is still low compared to last October, which reinforces price fluctuations in both directions.

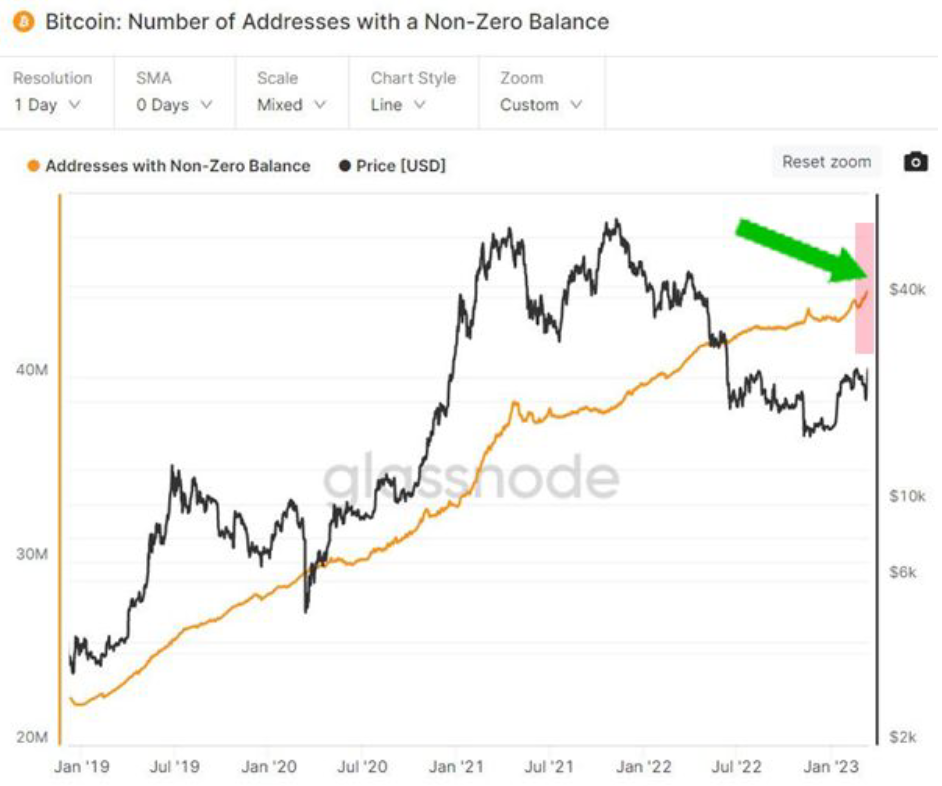

- Bitfinex analysts examine how the number of new BTC wallets is changing and say that the surge in this number, "in theory", also indicates an increased demand for BTC. Almost a million new BTC wallets were counted in just one month.

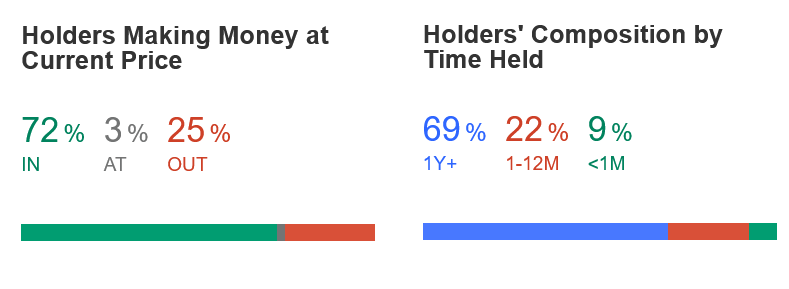

- It is also estimated that, at current prices, 72% of BTC addresses are already profitable.

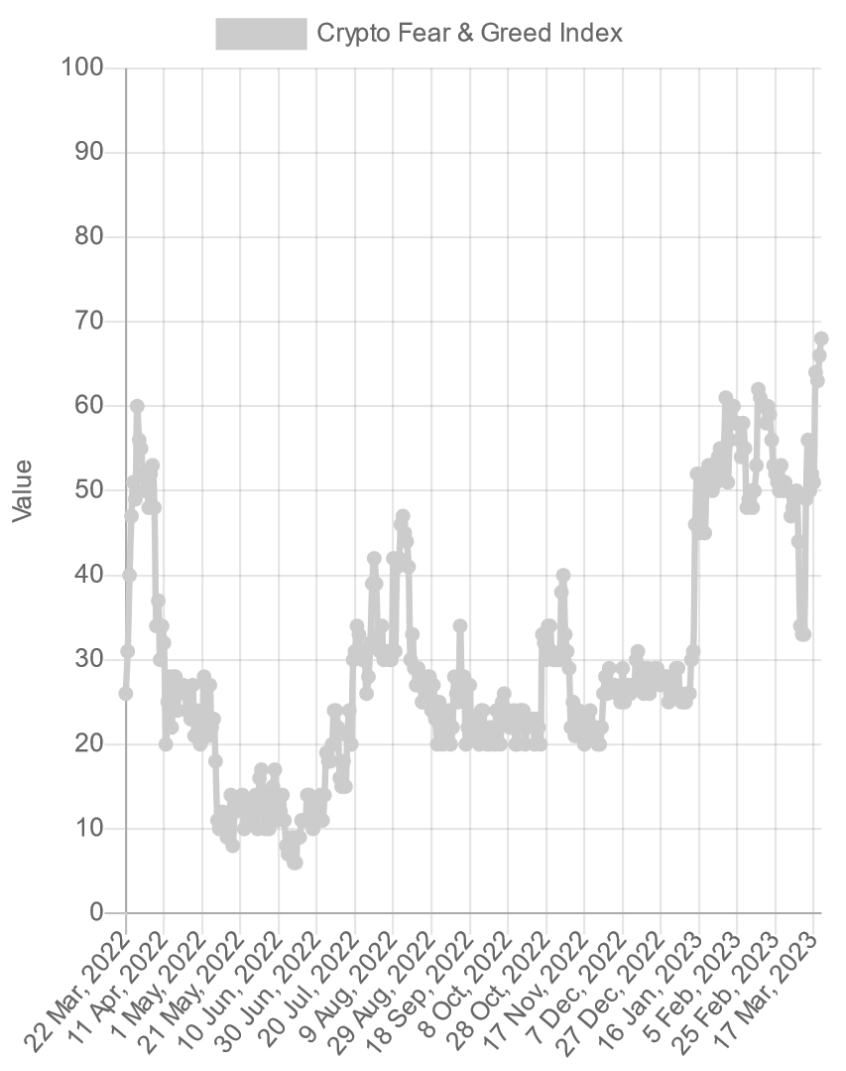

- Meanwhile, the "Fear and Greed Index" indicates a further strengthening of "Greed" and is at its highest since November 2021 when BTC reached its all-time high (around USD 69,000).

Daily Podcast

As in the market, discussions about banks continue to dominate this section because it may be time to really understand who is taking care of our money, which, when banks start to care about them, may not be very much ours. 🙃

Today we're listening to Caitlin Long, founder and CEO of Custodia Bank, who wants to launch a full-reserve bank in the US, thus reducing the risks that bank customers may lose money, but US regulators for some reason do not want to admit such a bank.

Caitlin says:

- Banks that lost billions of deposits per day finally realized what banking means nowadays when technology allows for immediate money transfers, which accelerated, for example, the collapse of Silicon Valley Bank.

- People should have a choice of which bank they want to use: either one where you simply keep your money safe and pay for it, or one where service fees may be lower, but your money is loaned out to others by the bank.

- Now, banks operate similar to leaving your car in a parking lot, and the owner of the lot renting it out to an Uber driver, passing on the associated risks to you.

The Fed chairman stated that the banking system is stable. - The price of BTC fluctuates greatly, but the system is stable. Meanwhile, the value of the US dollar is stable, but the system is unstable.

Discussions about fractional reserve banking are more interesting and complex than some Bitcoin enthusiasts would like to show. And there are various questions without clear answers, for example, how would the world economy have developed without fractional reserve banking, which makes it easier to distribute loans? However, the answer is not really clear.

(The video can also be found here, or you can listen to the conversation here.)

The talk of the town

An (un)funny story about the risks associated with trust in the traditional investment world that came to light over the weekend now has a follow-up, and I'm returning to it.

In short, over the weekend, it was revealed that the London Metal Exchange (LME) discovered bags of rocks in its Rotterdam warehouse, where nickel, which is traded on the exchange, was supposed to be stored. The value of the nickel in question (USD 1.3 million) accounted for about 0.14% of all LME nickel. Whether this was a mistake, theft, or fraud is unclear, but it's not the first similar case. For example, several banks suffered over USD 300 million in losses in 2017 due to forged ownership documents for nickel, and trading giant Trafigura announced in February that it could face over USD 500 million in losses after discovering that the cargo it bought did not contain nickel. (Similar stories have occurred with gold.)

Meanwhile, unconfirmed reports suggest that investment banking giant J.P. Morgan Chase (JPM) was the one who invested in nickel contracts covered with these bags of rocks on the LME a few years ago.

BTC advocates have not only had the opportunity to remind us that such fraud/mistakes are impossible with BTC because you can always easily verify that the BTC received is indeed BTC, but also to mock frequent BTC critic, JPM CEO Jamie Dimon.

JPM CEO Jamie Dimon says #Bitcoin is a ‘hyped-up fraud’ and cryptocurrencies are a ‘waste of time’—/ JPMorgan Chase

— moneyordebt ∞/21M (@moneyordebt) March 21, 2023

thought it had $1.3 million worth of nickel stored in a warehouse..closer examination revealed bags of stones. #POStones @jpmorgan https://t.co/ovG9FtB4dy

Meme of the Day

🫣

How it feels watching the banking system rn

— CMS intern (@cmsintern) March 19, 2023

pic.twitter.com/KFjP6DbfIs

Komentarai